Overview of the Skincare Industry in Indonesia

Indonesia as the largest economy in Southeast Asia has been seeing steady economic growth over the years. One of the growing industries in Indonesia in recent years also includes the skincare industry. Skincare, a product deemed as a luxury a few years back for many Indonesians, has now become a lifestyle for a lot of Indonesians as the Indonesian population is now getting more concerned about maintaining their looks and well being. Therefore, in this article, we will focus on the skincare market trends in Indonesia.

Indonesia has always been known as a market with a lot of potential for eCommerce businesses. As of 2019, Indonesian eCommerce revenue amounts to US$ 18.7 billion. McKinsey’s projection predicts that this number is due to growing to a staggering US$ 40 billion by 2022. When it comes to the skincare market specifically, the projection shows healthy growth. The market that is worth US$ 1.98 billion at the moment is projected to grow by more than 20% by 2023. The above figures considered space is not a problem for eCommerce businesses wanting to join the skincare market race in Indonesia.

Local and global skincare brand penetration in Indonesia

Although a lot of International skincare brands are used in Indonesia, local brands are still preferred by many Indonesians for a reasonable price and good quality. When it comes to the frontrunners of the skincare market in Indonesia, multinational corporations with a local presence in the country are still enjoying the biggest shares of the pie with Unilever Indonesia, P&G Indonesia, and L’Oréal Indonesia leading the race. However, they are facing competition from Korean brands who are taking bigger shares in the Indonesian skincare market since 2019. This is shown by how the top players are seeing a decline in market share despite their ever-increasing sales in 2018.

Some of the more favored International brands include SK-II, L’Oréal. Korean Brands such as Laneige, The Body Shop, Innisfree, Nature Republic lately are receiving a lot of attention from Indonesian consumers. While the leading local brands include Wardah, Sari Ayu, Mustika Ratu.

Skincare Market Opportunities and Strategies

When it comes to choosing the right products, consumers are becoming increasingly sophisticated and demanding when buying skincare, with a growing number of researching products online in the hope of achieving optimum skin condition. Brands who understand social media win over millennial consumers. Rakuten Insight’s research in 2019 found that out of Indonesians who use Korean beauty products, 39% of them obtain information from social media beauty influencers. As a result, reviews from beauty influencers in Indonesia have a lot of impact on brands.

Natural ingredients are currently one of the trends that Indonesians are looking for in their skincare products as Indonesians are increasingly becoming more aware of the use of chemical products in their daily lives. The mass media in Indonesia has also been very keen to cover how exposure to chemical ingredients found in day-to-day items including cosmetics and skincare may bring a negative impact on health. Kilala Tilaar, Corporate Director of Creative and Innovation from local beauty product giant Martha Tilaar Group believes that natural or organic beauty products will still be a significant driver for the country’s care industry. He added that research has shown that Indonesians, especially the millennials, still have a positive bias towards natural, organic, and eco-friendly products.

The market segment for skincare products has also expanded as people are gradually getting rid of the stereotype that beauty and skincare products are only for women. More brands are targeting skincare products for men, including facial cleanser, moisturizer, anti-aging serums, and other skincare items. Skincare concerns rise in 2019, with women increasingly seeking natural products while men prefer trusted brands.

COVID-19 Pandemic Impact on the Skincare Market

The short-term impact of COVID-19 on the skincare industry

After the COVID-19 situation, first-quarter sales have been weak, and there have been widespread store closures. However, the industry has responded positively to the crisis, with brands switching their manufacturing to produce hand sanitizers and cleaning agents and offering free beauty services for frontline response workers. Even though the economic magnitude of the COVID-19 pandemic on brands and retailers will be far greater than any recession, there are signs that the beauty industry may once again prove relatively resilient.

Despite the current COVID-19 situation, most product areas in skincare are still expected to see stronger value growth at constant 2019 prices in 2020. Many consumers are opting to wash more frequently in the hope of preventing the transmission of the virus, often every time they return home, with this boosting the use of post-wash skin care including body care and moisturizers and treatments and also supporting stronger sales growth for facial cleansers. According to Google search trends, searches on skincare has increased up to 230%, while searches for skincare products have risen by 130% since the COVID-19 pandemic started in Indonesia.

What beauty products are being purchased during the pandemic?

Given the realities of working from home, physical distancing, and mask-wearing, it has become much less important to wear makeup and fragrance. With more people working from home and generally staying in, lower-maintenance looks are the go-to. A survey by Bazaarvoice was made on 5,100+ women of the influencer community over the age of 13-years-old to share how their routines and shopping behaviors may have changed during the pandemic week-over-week.

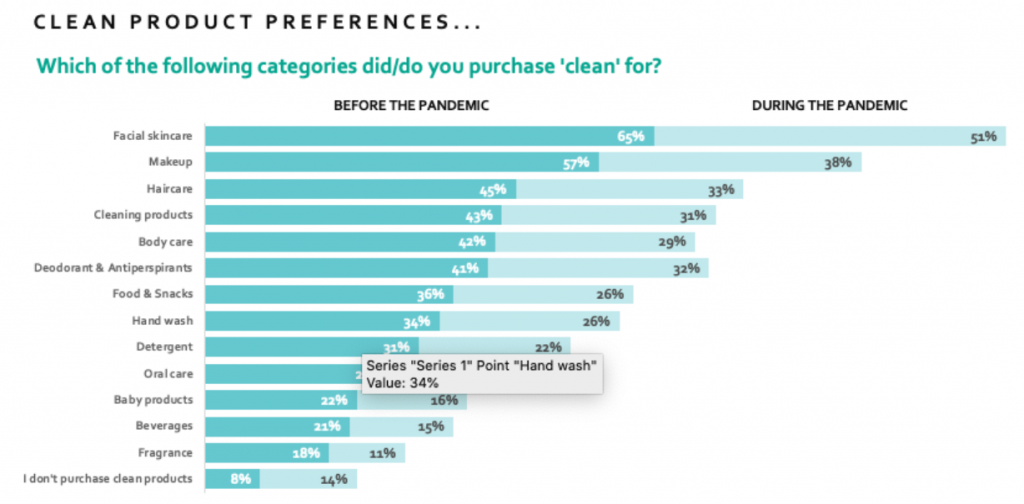

Pre-pandemic, 93% of women said they were “more inclined” to buy clean beauty products and used product reviews, social media, online searches, and brand sites to research products and make sure ingredients were nontoxic, sustainable, vegan, hypoallergenic, or cruelty-free. We found that 43% of shoppers are still prioritizing clean products during the pandemic, and 68% still read ingredient labels before purchasing. Facial skincare, makeup, and hair care are the most-purchased clean beauty categories, both before the pandemic and now.

The long-term impact of COVID-19 on the skincare industry

Digital continues to rise. Pre-COVID-19 trends will likely accelerate, with direct-to-consumer e-commerce, such as brands’ websites, shoppable social-media platforms, and marketplaces becoming more important.

The pace of innovation accelerates. As the COVID-19 crisis has shown, the world can change quickly, bringing substantial shifts in demand. Sometimes, supply cannot catch up. Even before the pandemic, brands were under pressure to overhaul their product-innovation pipelines, inspired by the ability of digital-native direct-to-consumer brands to go from concept to cupboard in less than a month. Now, the need for speed is even greater.

—

Overall, the skincare market in Indonesia continues to grow annually. The competition between national and international skincare brands in Indonesia is still tight between each other. Despite the negative impact of COVID-19 has given to industries worldwide, the skincare industry could still see the silver lining in this situation as the pandemic opened several doors for the industry with the increase in demand for skincare and cleansing products during the period.

BRIGHT Indonesia will help you enter the market

BRIGHT Indonesia provides several services such as comprehensive market research regarding the skincare industry, arranging partnerships in the local industry, and creating sales programs based on market research.

Our Market Insight Research, Business Partnership Engagement, and Business Registration and Establishment services can help you in expanding and developing your business, register and establish your products and company, as well as obtain the work and stay permit in Indonesia (expatriates utilization plan (RPTKA), expatriates utilization permit (IMTA), limited stay permit (KITAS)) easier.

Our strategy consulting services domain focuses on supporting private sector clients with comprehensive and specialize development regarding the company’s needs and also on the public sector for a broader scope. For more information, email to info@brightindonesia.net.

Hello,

I would like to understand what are the most purchased skincare products in these categories Treatments, facial cleansers, and moisturizers. Which one skincare product is trending and will keep raising post-Covid

Hello,

Thank you for your interest in the industry. We did more in-depth research and can help you on this. For more information, please email to primadi.ws@bright-indonesia.net and info@brightindonesia.net.

Have a great day!

Hi Bright,

I am an individual currently working on a green project to experiment on creating a sustainable beauty brand that involves an upcycling process. May I know the terms and conditions on how to gain market research and insight of Indonesia Green Market opportunity from you? As of right now, we are still in the initial stage of scientific research and business initiation. Thank you

Hello,

Thank you for your interest in the industry. We did more in-depth research and can help you on this. For more information, please email to primadi.ws@bright-indonesia.net and info@brightindonesia.net.

Have a great day!

The issue of acne is commonly related to teenage years, and whereas it’s true that

acne arises most continuously during the adolescent years, it is also true that there is an growing quantity of people who undergo from grownup acne.

My web page lagom mist toner