How would automation engineering change Indonesia’s industrial landscape?

Production and Automation Engineering Industrial Overview

As Indonesia’s economy accelerates over the next 15 years, automation suppliers will play an important role in the development of the country’s manufacturing and energy industries, as well as in the modernization of infrastructure. Industrial automation is a process of applying different and combined control systems to manage and operate machines and equipment in production facilities and factories. In addition to reducing costs, industrial automation is being demanded to help increase productivity, efficiency, aesthetics, and delivery systems in the production of automotive assemblies, aircraft, steering and ship stabilization, heat treating boilers and ovens, and other machinery.

The Automation and Control System Market in Indonesia was estimated to be valued at $205,217 million in 2019 and is projected to hit $334,805 billion by 2025, with a CAGR of 8.5% over the forecast period 2020 to 2025. While Taiwanese and South Korean firms lead the industry in automation, Indonesia will become the area’s production hub and the factory for Southeast Asia. In 2018, the inflow of investment has made Indonesia the epicenter of manufacturing automation, and many established and creative foreign producers are planning to set up or expand their manufacturing facilities in Indonesia.

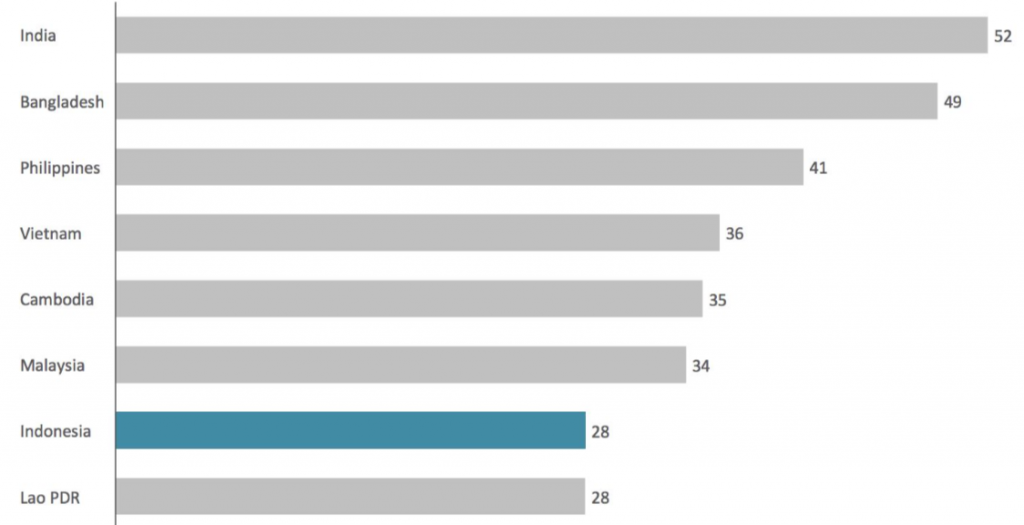

Overall, International comparisons indicate that Indonesia has more to gain from automation. Only 28% of Indonesian businesses reported that they were automating manual processes in 2015. This rate is lower than that of the regional peers of Indonesia, including Vietnam, Cambodia, and Malaysia, where about 35% of companies invested that year in automation. In India and Bangladesh, where about half of all firms have increased their use of automation, the difference is even greater as we can see here:

Why is Indonesia’s automation uptake low compared to its neighbouring countries?

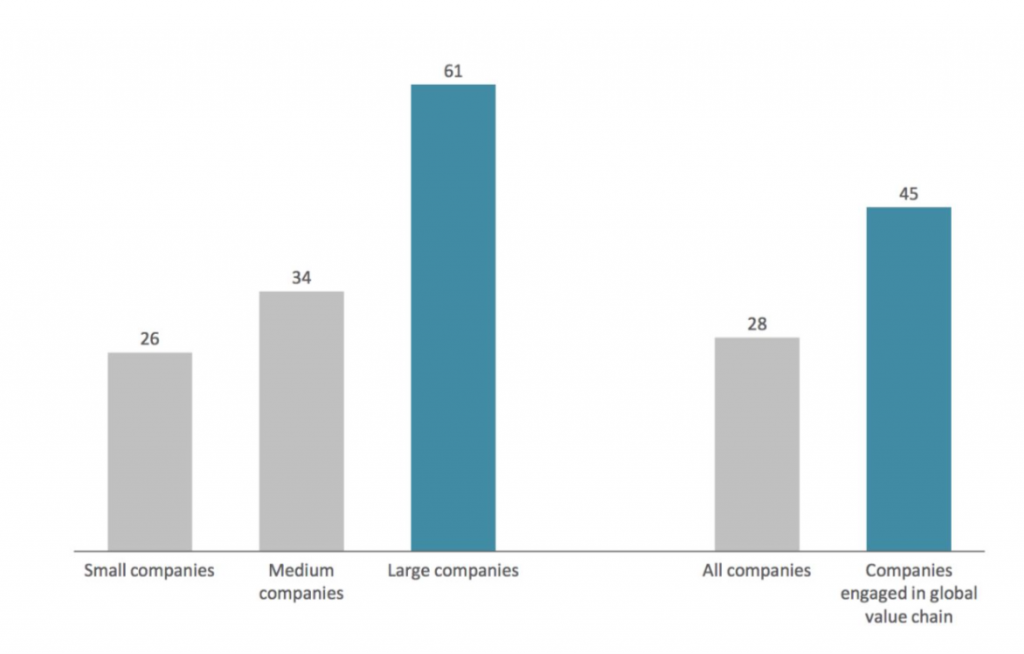

Looking at the previous graph, one might wonder why the uptake of automation in Indonesia is low. The difference between countries is possibly due to company features. Indonesia has a small number of large, globalized firms, and a large number of smaller, informal businesses with relatively little participation in global trade. The graph below displays the rate of automation in firms of different sizes and market orientations. In Indonesia, smaller companies are less likely to participate in automation. In 2015, only 26% of small businesses reported investing in automation technology, compared to 61% of large firms. Small companies may lack the scale to justify costly automation investments and find especially acute automation, such as access to skills and finance.

The decision to automate is also affected by trade orientation. More globalized companies may be pushed to automate by international competition or global corporate headquarters. Due to their size, business models, and relation to international networks, they may find it easier to resolve barriers to automation. In 2015, 45% of Indonesian companies participating in global value chains invested in automation. The Indonesian government is currently increasing funding to encourage automated systems in numerous manufacturing sectors, grow innovations of industrial robotics, and expand the demand for mass production and related supply chains to cater to the rising population.

Which industries implement automation the most?

The oil and gas industry dominates the market for automation and control as there is constantly a huge demand from exploration to distribution for protection and reliability. Furthermore, oil and gas companies in Indonesia have to invest regularly in integrated automation technologies due to their huge production capacities and to be more transparent (given the various regulations related to performance and tighter limitations on carbon emissions). Additionally, because of their large production potential, fast-moving consumer goods manufacturers in Indonesia are beginning to rely more on automation facilities.

How is Automation implemented in Indonesia’s industries?

Indonesian manufacturers are a diverse community with varying potential for creativity and willingness to implement new technology. Surveys found that in their activities, only 6% of businesses used emerging technologies, 30% of them had introduced technology to an intermediate degree, and 64% had introduced only basic technology. The survey focused on five manufacturing sectors (food and beverage, automotive, textiles and clothing, electronics, and footwear) which together provide 51% of all Indonesian manufacturing value and 58% of manufacturing employment.

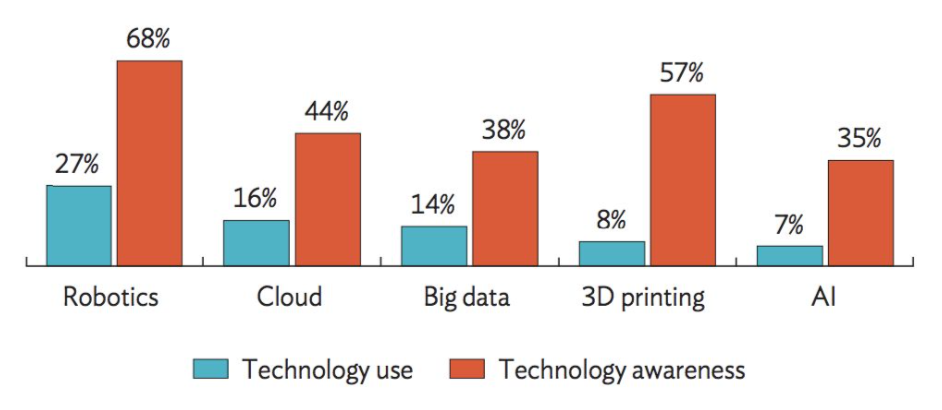

A relatively small 6% of businesses have embraced new technology and have used emerging digitally-enabled tools. Almost two-thirds (64%) of the businesses surveyed have embraced little technology and still perform several activities using basic tools such as spreadsheets and e-mail. The most widely used Industry 4.0 technology among the companies surveyed is robotics. Awareness of other emerging technologies is low — and especially low for less mature technologies such as AI as shown here:

Variations in impact are also expected across sectors. In the machinery and equipment and automotive industries, productivity surge is projected to be highest, and lowest in the mining, agriculture, and food and beverage industries. By 2040, machinery industry output could be 42% above its baseline if new technologies are adopted, while the motor vehicle industry could expand by 28%. The third-largest expansion is expected in the financial sector, up 19% from the baseline:

Different types of technology are likely to drive different types of change across sectors. For example, advanced robotics and automation technologies are expected to have a more direct effect on discrete industries that incorporate a wide variety of components, such as automotive and electronics, than on process industries that use continuous methods of production, such as food and pharmaceuticals.

Are jobs lost to automation? Yes, but they are created as well.

Automation has a large impact on jobs. Many low-tasks jobs are replaced by machinery. However, according to a report by McKinsey, even with the introduction of automation and the associated possible loss of such workers, they find that by 2030, the number of net new jobs generated (i.e. the difference between jobs acquired and jobs lost to automation) ranges from 4 to 23 million!

Indonesia would need an integrated effort to aid skills transformations in workers so that the country can reap the full benefit from automation’s productivity boost. To meet the challenge and respond to the needs of a changing world, all stakeholders (including educational institutions, the government, and business) will have to act rapidly in a coordinated way.

Challenges for the Automation and Control System Market

Several market challenges impede the growth of automation engineering in Indonesia. We narrowed them into 5:

1. Indonesian firms are not aware of emerging technologies

New technologies are complex and changing constantly. Industry consultations show that businesses are not very conscious of emerging technologies and their potential applications. The lack of understanding of the advantages of emerging technologies and the possible high return on investment in them by company managers presents a major barrier to the adoption of technology in many companies in Indonesia.

2. Social pressure to preserve existing jobs

Businesses face substantial social and political pressure to preserve jobs. This disincentives automation even where it could increase competitiveness and growth and ultimately create new employment.

3. Limited access to skills and finance

There is a general constraint on financial capital and technological skills in Indonesia, both of which are critical to enabling automation; this constraint is particularly true for smaller businesses. Exploiting the advantages of emerging technology requires businesses and staff to be able to create new methods and business models to understand, implement, and adapt them. This requires new skills at all levels of the firm, from shop-floor technicians to managers and directors.

In Indonesia, efforts are underway to resolve skill gaps, especially through increased enrollment in technical and vocational education. Industry surveys reveal, however, that the absence of staff with the right skills is now preventing Indonesia from seizing the opportunities provided by new technologies. As quoted from the Asian Development Bank:

“Technological assistance — for training, market research, and contract R&D — is limited across the country and lack of expertise in cutting-edge technology could hinder its widespread adoption.”

4. Limited supportive infrastructure

Despite the current investments, digital infrastructure gaps in Indonesia persist, especially in regions outside Java. Private investors are frustrated by perceived regulatory barriers. Advanced innovation requires commensurate infrastructure and institutions to seize the opportunities that arise from new technologies and overcome the obstacles along the way to future economic growth.

5. Legal and administrative concerns

Businesses seeking to automate face a range of business concerns including assurance of property rights, enforcement of contracts, confidence in the tax system, and the ability to efficiently register, operate, and dissolve companies. Furthermore, the labor law makes it difficult and expensive to make workforce changes to adjust to automation. Harmonization is also lacking between national and sub-national laws and regulations on technology.

Opportunities in the Automation and Control System Market

What opportunities should automation players look into? Well, Indonesia’s Industry 4.0 entry strategy targets five manufacturing sectors to become pilots in strengthening the fundamental structure of the national industry. The five sectors are namely Food and Beverage Industry, Automotive Industry, Electronics Industry, Chemical Industry, and the Textile Industry.

The strategy will, therefore, encourage the Indonesia Investment Coordinating Board (BKPM) to carry out its role in promoting direct foreign and domestic investment in those sectors. The Ministry of Industry also encourages not only large-scale industries but also small and medium industries (IKM) to participate in capturing opportunities in the era of Industry 4.0.

The Asian Development Bank also reported some opportunities for automation across several industries:

● Robotics for hospitality and food services.

● Automatic domestic lighting and systems for home security and energy efficiency

● Digital platforms to integrate sales channels and the use of delivery drones in urban and rural areas alike.

● Low-cost robotics to substitute traditionally manual operations such as tea-leaf plucking.

● Digital tools to reduce material waste.

BRIGHT Indonesia as a Perfect Local Partner

Overall, automation is expected to have an increasingly important role in Indonesia’s industrial landscape. While the country’s automation uptake was reported to be only 28% in 2015, this number is predicted to rise as the government’s ‘Industry 4.0’ strategy pushes for supportive legislation and investment in five priority sectors to increase the use of automation to increase productivity. Firms in the Automation and Control System Market are encouraged to capture the opportunities that lie in the market while at the same time, taking into account the five mentioned challenges. However, despite the challenges, to register in Indonesia Automation Industry there is one thing to note. Having the right local partner can be really helpful and so important.

BRIGHT Indonesia is a perfect partner for your company. BRIGHT Indonesia will assist you on the ground, including virtual assistant during the mission, logistic arrangement, and communication of every detail. It can make your company focus on developing partnership cooperation without thinking further about the hassle during the business trip.

BRIGHT Indonesia provides several services such as Business Partnership Engagement, Management and Strategy Consulting, and Foreign Direct Investment Promotion services that can help you in expanding and developing your business, register and establish your products and company, as well as obtain the work and stay permit in Indonesia ((expatriates utilization plan (RPTKA), expatriates utilization permit (IMTA), limited stay permit (KITAS)) easier.

BRIGHT Indonesia always strives to give excellent services designed only to fulfill your company’s needs with experiences in assisting multiple global clients in entering Indonesia and Southeast Asia Market. These collaborations are proof of our unrivaled service.

For more information, email info@brightindonesia.net.