An overview of the energy sector and its opportunities.

Indonesia’s Energy Sector Overview

The primary energy supply in Indonesia comes from fossil fuels such as oil and gas. More specifically, 62% of electricity is generated by fossil fuel and 21% by coal and natural gas in 2019. Renewable energy such as hydro and geothermal, conversely, still makes up only a small percentage of the energy supply. To increase this percentage, in 2019, the State Electricity Company (widely known as PLN) began the construction of the country’s biggest hydropower plant (PLTA) in North Kalimantan to generate 1,350 megawatts of energy upon completion in 2025.

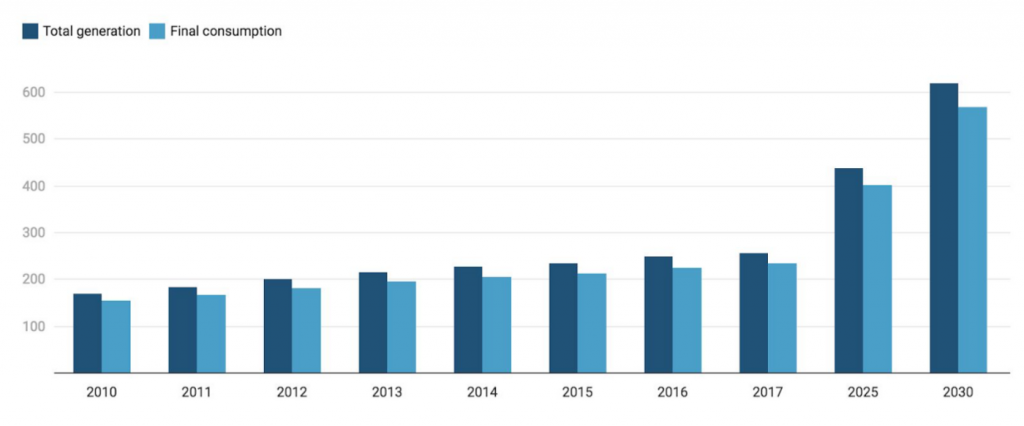

Using the 13-years CAGR of 5.8% between 2018 to 2030, it is predicted that the country’s total electricity consumption will reach 568 billion kWh in 2030. This is 2.4 times more than the consumption in 2017 as shown in the graph on the left that illustrates Indonesia’s total electricity generation and consumption.

Fuelled by robust economic development, increasing urbanization, and steady population growth, Indonesia is the largest consumer of energy in ASEAN with nearly 40% of total energy use among ASEAN members. Energy usage increased by 65% between 2000 and 2014 and is forecasted to grow another 80% by 2030. This growth comes mostly from transportation and industrial activities that are both heavily dependent on oil. In this aspect, it is important to note that Indonesia’s oil production has been declining in the past few years, indicating an increase in oil imports and the need for Indonesia to switch to another energy source in the coming years.

What is the impact of COVID-19 on the energy sector?

The hardest-hit on energy demand came from the oil industry since it is the product most-related to transportation and industrial fuel. Travel restrictions drag oil prices down from oversupply. Furthermore, the price war between Saudi Arabia and Russia brings the oil price to $30 per barrel; the lowest price within the last two decades. Similarly, as China’s coal production has recently recovered, oversupply and price decrease for coal has started to appear. LNG price is still maintained as a result of the long-term contract scheme. In contrast, the demand for renewable energy is not affected but the drop in oil price might threaten the renewable energy transition agenda. Some disruption in the supply chain is also likely to occur due to Covid.

The Coal Industry

With the widespread availability of coal reserves in Indonesia and easy access to coal-related technology, coal is still a dominant source for the country’s energy mix. It is predicted that coal will generate an annual average of 61% of the total electricity output over the course of a ten year forecast period through 2028. While the performances of other industries were declining in 2019, this industry thrived fueled by higher consumption and newly opened coal-fired power plants.

However, the coal industry is not doing well with the pandemic due to the rapid price drop. Besides, as this drop in price was unexpected by even as late as February 2020, managers were not in the position to proactively cut costs. This created cash operating challenges for many Indonesian coal producers. Bumi, ABM, and Geo Energy are the three firms with the lowest cash cushion under a US$58/tonne benchmark price. The COVID-19 also created disruptions to labor, transport, and the raw materials and coal supply chains. Managing any form of mining activity under current conditions with unpredictable staffing levels and end-user demand would be difficult.

The Petrochemical Industry

In 2019, investment in Indonesia’s oil and gas industry reached around $12 billion. While Indonesia still has reserves of oil and gas, it needs substantial investment and technology for exploration. Note that much of the remaining reserves require sophisticated technology that Indonesia’s SOE operators do not currently have as protectionist policies discourage global energy companies from pursuing such opportunities to supply. This in turn limits the country’s production output; overall, the country’s oil production declines by 11% per year.

Currently, Indonesia’s petrochemical industry can only supply 30% of the domestic demand, relying the rest on imports. Indonesian President Joko Widodo is aiming to stop the import of petrochemical products by 2024. Quoted early this year, the President Director of Pertamina sees this government target as an opportunity for domestic oil and gas business.

Pertamina has stated that it will aim to fill the gap of domestic petrochemical demand and supply by integrating petrochemical production facilities in all of its refineries. The integration should allow the facility more flexibility to switch from producing gasoline (whose demand is declining) to petrochemical products. Pertamina will also continue its refineries projects and support the Government’s oil production target.

The Solar Industry

REmap identifies the potential for 47 GW of installed capacity by 2030; this includes plans to use solar PV to provide electricity to 1.1 million households in remote areas that currently lack access to electricity. In Java-Bali (where 70% of power demand comes from) there is enough available space and adequate infrastructure to increase rooftop and utility-scale solar PV installations.

The government is paying more attention to the rooftop solar power segment and aims to stimulate its development. This industry remained unregulated until 2018 when the MEMR issued Regulation №49 of 2018 on the Use of Rooftop Solar Power Systems by PLN Customers (MEMR 49/2018). The subsequent amendment of this regulation intends to simplify licensing and certification requirements for own-use power generation. MEMR 16/2019 reduces capacity charges of industrial PLN customers and eliminates emergency energy charges, resulting in more economic viability in providing solar PV electricity. Capacity charges were previously one of the main hindrances for the industry.

Prior to MEMR 16/2019, PLN industrial customers had to pay a 40-hour capacity charge which was the same charge as PLN customers that had a coal or gas power plant. Given that the amount had been reduced to 1/8 of the original, it can be expected that in 2020, many companies will opt for solar photovoltaic electricity.

The implemented change corresponds to the issued 2019–2028 PLN Electricity Supply Business Plan (RUPTL) where PLN sets as a target to optimize solar energy utilization for electricity.

The Hydropower Industry

Hydropower energy supply amounted to around 40.2 million barrels of oil equivalent in 2019. The development of hydropower will be driven in part by the government’s aim of growing the share of renewables in the country’s total energy usage to 23% by 2025; the figure for 2015 is about 5.87%. Nevertheless, subsidized fuel prices and the rapidly evolving legal and regulatory climate have dissuaded investment in renewable technologies. Seven hydropower stations totaling 1,559 MW are currently under construction in Indonesia, despite these challenges. Furthermore, as quoted from the International Hydropower Association, “a further ten projects totaling 1,819 MW are subject to power purchase agreement (PPA) negotiations, while 19 projects totaling 2,131 MW are in the study or design phase.”

The 1.040 MW Upper Cisokan facility, a pumped storage project located in western Java, is the largest project currently under construction. The project is being developed by Daelim of South Korea and Astaldi Group of Italy, in a joint venture with Wika, an Indonesian company. The overall project cost is projected at USD 800 million and will be backed by the World Bank’s investment loan of USD 640 million.

The Geothermal Industry

According to the government, Indonesia is ready to use approximately 23% to 31% of renewable energy between 2025 and 2050. The reasons for this is because Indonesia has the world’s greatest hydropower and geothermal potential (with 40% of the geothermal reserves in the world).

To further develop the Geothermal industry, the Indonesian Ministry of Finance introduced a geothermal drilling program that aids in risk mitigation of projects to attract more private investments in September last year. A deal was also struck with the World Bank for a $150 million loan to support the growth of the industry. Indonesia’s three biggest new renewable energy projects last year were all geothermal power plants: the 85 MW Muara Laboh plant, the 42.3 MW Sorik Marapi and the 55 MW Lumut Balai.

The Marine Energy Industry

Indonesia has immense potential for marine renewable energy, consisting of wave or tidal strength, sea current, and OTEC. The MEMR data shows that the total theoretical capacity of marine energy is estimated at 216.61 GW and the practical capacity at 60.985 GW, more than double the estimated potential geothermal energy capacity. In Indonesia, however, the tidal and sea current capacity has not yet been commercially established, although some preliminary studies have been conducted in some areas.

In the Larantuka Strait in eastern Flores, a concrete tidal wave project will be developed, taking advantage of the powerful strait current that separates Flores and the smaller island of Adonara. A Dutch company will build the tidal wave power plant in this project via a ‘tidal bridge’, in which the turbines will be installed under the bridge.

The Wind Energy Industry

In Indonesia, average wind speeds range from 1.3 to 6.3 m/s. In the east and west of Nusa Tenggara (eastern and western part of the Lesser Sunda Islands, central south and eastern south of Indonesia), the major wind energy potential areas are located with average wind speeds of more than 5 m/s. The approximate wind power capacity in Indonesia is estimated at around 9 500 MW. Indonesia, however, with an installed capacity of around 1.2 MW, is lagging behind its ability. The production of renewable energy in Indonesia is currently governed by Presidential Decree №5/2006 on national energy policy and the 2005 Energy Blueprint.

The New & Renewable Energy Sub-Directorate of the Directorate-General for Electricity and Energy Utilisation has set a target of 250 MW of wind power on the grid and 5 MW of off-grid power in 2025. Via its wind energy road map, the Indonesian government has a strong promotion programme. In order to promote the creation of renewable energy projects, the Government of Indonesia has amended a range of laws in the energy and mining sector to grant provincial governments the right and duty to issue concessions and operating licenses for projects in the field of renewable energy and energy efficiency. PLN and MEMR are the key actors which provide permits and support to the project developers.

The Agency for the Evaluation and Application of Technology, the Ministry of Mines and Energy-Directorate-General for Electricity and Energy Production and the National Institute of Aeronautics and Space could be contacted for project development issues in order to create small-scale wind energy schemes. APETINDO, the Indonesian Association of Renewable Energy Sources, will include contracts with local consultancy, planning and engineering companies, as well as contacts with wind energy technology dealers. The project developer must contact PLN to link the wind farms to the Indonesian electricity grid.

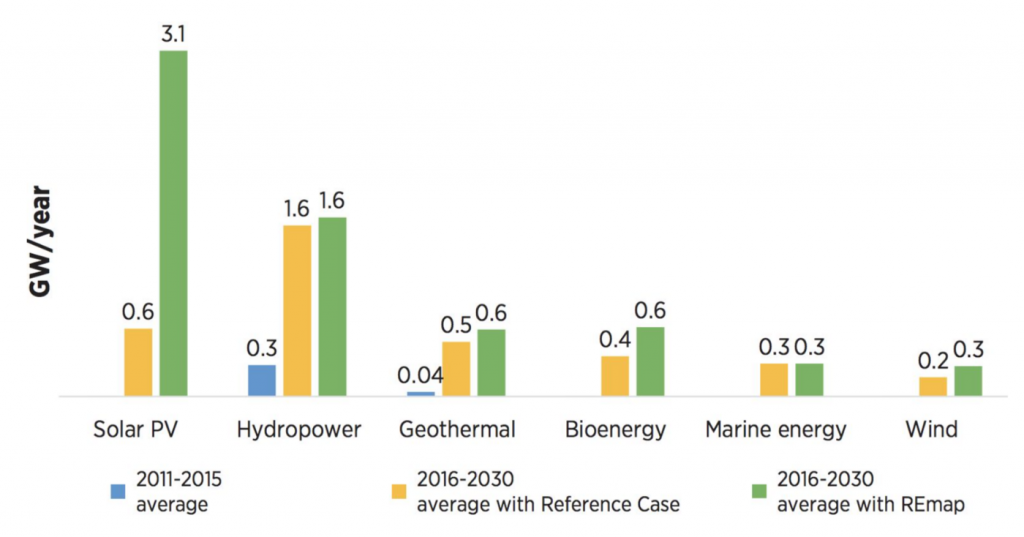

In this figure, we can see the historical and forecasted annual installations of renewable power in Indonesia:

Market Opportunities

The energy sector in Indonesia presents numerous opportunities as summarized:

1. Indonesia’s electricity consumption will more than triple by 2030. Economic growth means the rising use of electronic appliances. At the same time, Indonesia is expanding electricity access in remote areas and islands. The government is aiming for near 100% electrification by 2026.

2. Since renewable energy can strengthen Indonesia’s energy security, government policies have been supportive of this energy transition. Additional reasons for the government to support the production of renewable energy include the creation of 100,000 more jobs and stimulating technology transfer.

3. The government hopes to reduce exploration risk for the private sector in developing geothermal projects by offering a cost recovery scheme (one that is currently done for the oil and gas segment). In the oil and gas segment, such a scheme allows companies to be reimbursed by the government for their upstream-related costs in exchange for a share of the company’s earnings from exploiting domestic oil and gas.

4. The Energy and Mineral Resources Ministry proposed a regulatory reform in the green energy sector to introduce feed-in-tariff (FIT) pricing and allow arrangements other than build-own-operate-transfer (BOOT) contract schemes. The former guarantees fixed electricity rates for small renewable power plants, seeking to ensure predictable financial returns. The second proposal eliminates such a scheme that was criticized as impeding financing renewable energy.

5. Strategic programs are implemented by the ministry to encourage 2020’s energy sector performance. This includes accelerating refinery project decisions, launching oil and gas data access and capping the price of coal at $70 per ton for power generation.

BRIGHT Indonesia will Assist You to Enter the Market

To conclude, as Indonesia is a vast country with high energy and electricity needs, the energy sector will continue to have high growth prospects in line with population and economic growth. Considering Indonesia’s location and vast natural resources, immense opportunities remain untapped particularly in the hydropower, geothermal, marine energy, and wind energy industries that remain in their relative infant stages. International and local companies are encouraged to set themselves up in the aforementioned industries and take hold of the five market opportunities mentioned.

BRIGHT Indonesia’s Market Insight Research, Business Partnership Engagement, Business Registration and Establishment, and Management Strategy and Consulting services can help you in expanding and developing your business, register and establish your products and company, as well as obtain the work and stay permit in Indonesia (expatriates utilization plan (RPTKA), expatriates utilization permit (IMTA), limited stay permit (KITAS)) easier.

Our strategy consulting services domain focuses on supporting private and public sector clients with comprehensive and specialized development regarding the company’s needs and being prominent in the market.

For more information, email info@brightindonesia.net.